The Biggest Ponzi Schemes in the Caribbean

The Caribbean Has a Dark History of Ponzi Schemes Unfortunately

In my years of living and investing in the Caribbean, I've encountered stories of fraud and deception that are almost too wild to believe. Coming from a country like Canada, where these situations are rare, and the real estate and financial services sectors are tightly regulated, it’s taken time to understand why these schemes have been successful. We all appreciate that the allure of high returns can often cloud our judgment. This often leads individuals and investor groups to make bad decisions and take uncalculated risks. In this article, I explore the biggest Ponzi schemes in the Caribbean and the impact that they have had on the reputation and economic success of the region.

Named after Charles Ponzi, who in the 1920s promised to double investors' money in just 90 days, these schemes are a testament to the timeless adage that if something sounds too good to be true, it probably is. From Belgium's Moneytron to the United States' Great Ministries International, history is littered with tales of these sophisticated crimes, some involving sums upward of $500 million. I'm here to guide you through the biggest Ponzi schemes in modern history, shedding light on how they managed to dupe investors and the consequences that followed. It's a journey through the darker side of financial ambition, where the promise of extraordinary returns led to extraordinary collapses.

The Origins of Ponzi Schemes

The inception of Ponzi schemes dates back further than most realize, with the name famously originating from Charles Ponzi in 1920. Ponzi's operation was not the earliest of its kind but became one of the most renowned, laying the groundwork for understanding the mechanics behind these fraudulent investment strategies.

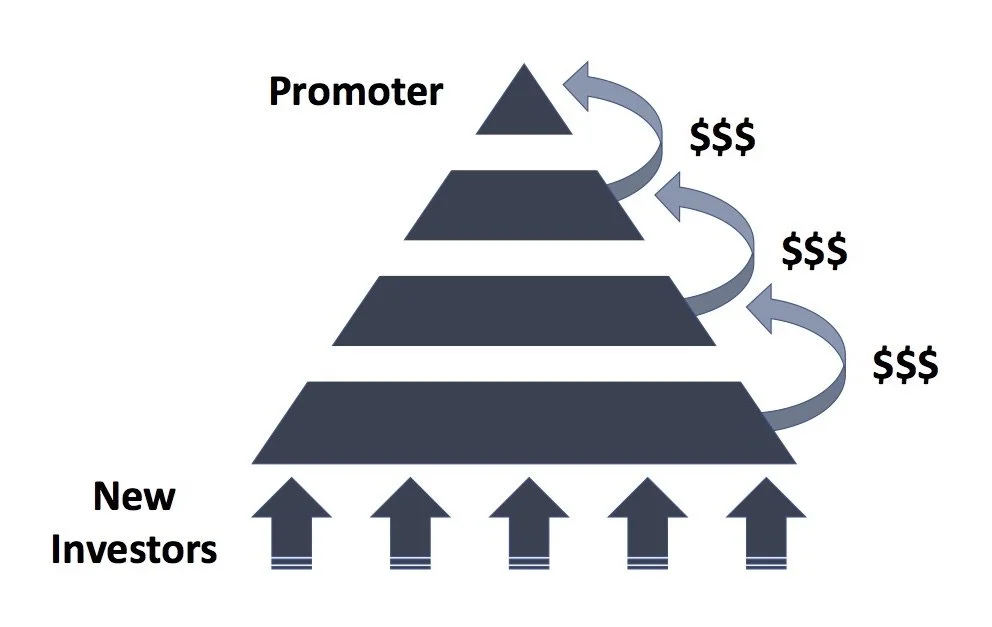

The inception of Ponzi schemes dates back further than most realize, with the name famously originating from Charles Ponzi in 1920. Ponzi's operation was not the earliest of its kind but became one of the most renowned, laying the groundwork for understanding the mechanics behind these fraudulent investment strategies. The concept is simple yet insidious, relying on the influx of new investors to pay returns to earlier participants, creating an unsustainable financial model that inevitably collapses.

Before Ponzi, there were instances in the 19th century that mirrored this fraudulent mechanism, which even found its way into literature through Charles Dickens' novels, "Martin Chuzzlewit" and "Little Dorrit." However, these earlier occurrences did not gain the same notoriety as Ponzi's scheme, primarily because of the sheer scale and audacity of Ponzi's operation.

In 1919, Charles Ponzi discovered an opportunity through the international postal system that seemed like a golden ticket. He capitalized on the disparities in international postage reply coupons, which could be redeemed in the U.S. for more than their purchase price abroad. This discrepancy was the basis of Ponzi's scheme, promising investors lucrative returns within a short period. His claim of a legitimate investment opportunity was enough to gather a vast pool of investors, eager for the promise of easy profits.

This method of using new investments to pay older investors underpins all Ponzi schemes, including some of the largest Ponzi schemes in history. Real estate Ponzi schemes, for instance, have become more prevalent, where schemers promise high returns from real estate investments with minimal risk. Figures like David Ames have become synonymous with such schemes, exploiting investors' trust and the allure of real estate investment.

Understanding the origins and mechanisms of Ponzi schemes is crucial for identifying potential frauds. The story of Charles Ponzi serves as a poignant reminder of the adage, "If it sounds too good to be true, it probably is," a cautionary principle that remains relevant in safeguarding one's investments against such timeless scams.

The Mechanics of Real Estate Ponzi Schemes

How does a Ponzi Scheme work?

Real estate Ponzi schemes represent one of the most sophisticated forms of financial fraud, often involving large sums of money and a wide array of participants. Through my analysis, I aim to dissect how these schemes operate and pinpoint the warning signs that potential investors should be vigilant of.

How Real Estate Ponzi Schemes Operate

In the basic structure of real estate Ponzi schemes, the operators promise high returns with low risk from investments in property markets. These promises are usually not backed by actual property investments but rely on the flow of money from new investors to pay returns to earlier investors.

The scheme starts with the organizer, who might present a lucrative opportunity in real estate, such as development projects or property flipping that supposedly generates significant profits. For example, figures like David Ames are notorious for their involvement in real estate Ponzi schemes, showcasing how they can lure investors with the allure of high returns in the property sector.

However, instead of investing the funds in real estate, the organizers use the money from new investors to pay returns to the initial investors. This creates an illusion of a profitable, burgeoning investment opportunity. The cycle continues as long as new investments keep coming in, which the schemers encourage by showcasing the high returns being made by the early investors.

The real estate Ponzi scheme's facade begins to crumble when it becomes increasingly difficult to recruit new investors or when too many investors try to cash out their returns. Without new contributions, the scheme cannot sustain the promised returns, leading to its eventual collapse. Often, the organizers may abscond with the remaining funds, leaving the investors with significant losses.

Red Flags to Watch Out For

5 Ways to Spot A Ponzi Scheme in the Caribbean

Identifying a real estate Ponzi scheme before becoming ensnared can save potential investors from significant financial harm. Several key red flags can signal the presence of a Ponzi scheme:

Guaranteed High Returns with Little or No Risk: Real estate markets, like all investment sectors, carry inherent risks and cannot guarantee high returns over short periods without some level of risk.

Overly Consistent Returns: Investments fluctuate with market conditions. Overly consistent returns, regardless of market dynamics, can be a sign of fraud.

Opaque Operations and Investment Strategies: Legitimate investments typically offer transparency about how and where the money is being used. A lack of clear, understandable information about the investment's operation could indicate a scam.

Pressure to Reinvest Profits: Schemers often encourage investors to roll over their returns into new "investments" to maintain the illusion of profitability and prevent them from cashing out.

Difficulty Receiving Payments: If receiving returns or cashing out investments becomes increasingly difficult, it might suggest that the scheme is struggling to recruit new investors to sustain payouts.

Biggest Ponzi Schemes in the Caribbean

Nassau, The Bahamas - Sam Bankman-Fried and the FTX Crypto Scheme

The Caribbean, known for its breathtaking landscapes and luxurious getaways, has also been a fertile ground for some of the biggest Ponzi schemes in recent history, particularly within the real estate sector. These schemes have enticed investors with the promise of high returns from exotic property developments, but beneath the tropical allure lies a much darker reality. These fraudulent schemes often mask themselves as legitimate real estate ventures, using the natural beauty and luxury of the Caribbean as a powerful tool to attract unsuspecting investors. Unfortunately, many have fallen prey to these scams, resulting in significant financial losses and a deep mistrust of investment opportunities in the region.

The allure of the Caribbean is undeniable, with its promise of paradise living combined with lucrative investment opportunities. However, this same allure has been exploited by fraudsters who craft intricate Ponzi schemes designed to defraud investors. These schemes typically rely on the continuous influx of new investors to sustain payouts to earlier ones, creating a cycle that is ultimately unsustainable. When the inevitable collapse occurs, the impact is devastating, leaving investors financially ruined and their dreams of owning a piece of paradise shattered. The Caribbean has seen several high-profile Ponzi schemes that have left deep scars on both the investors and the region's financial reputation.

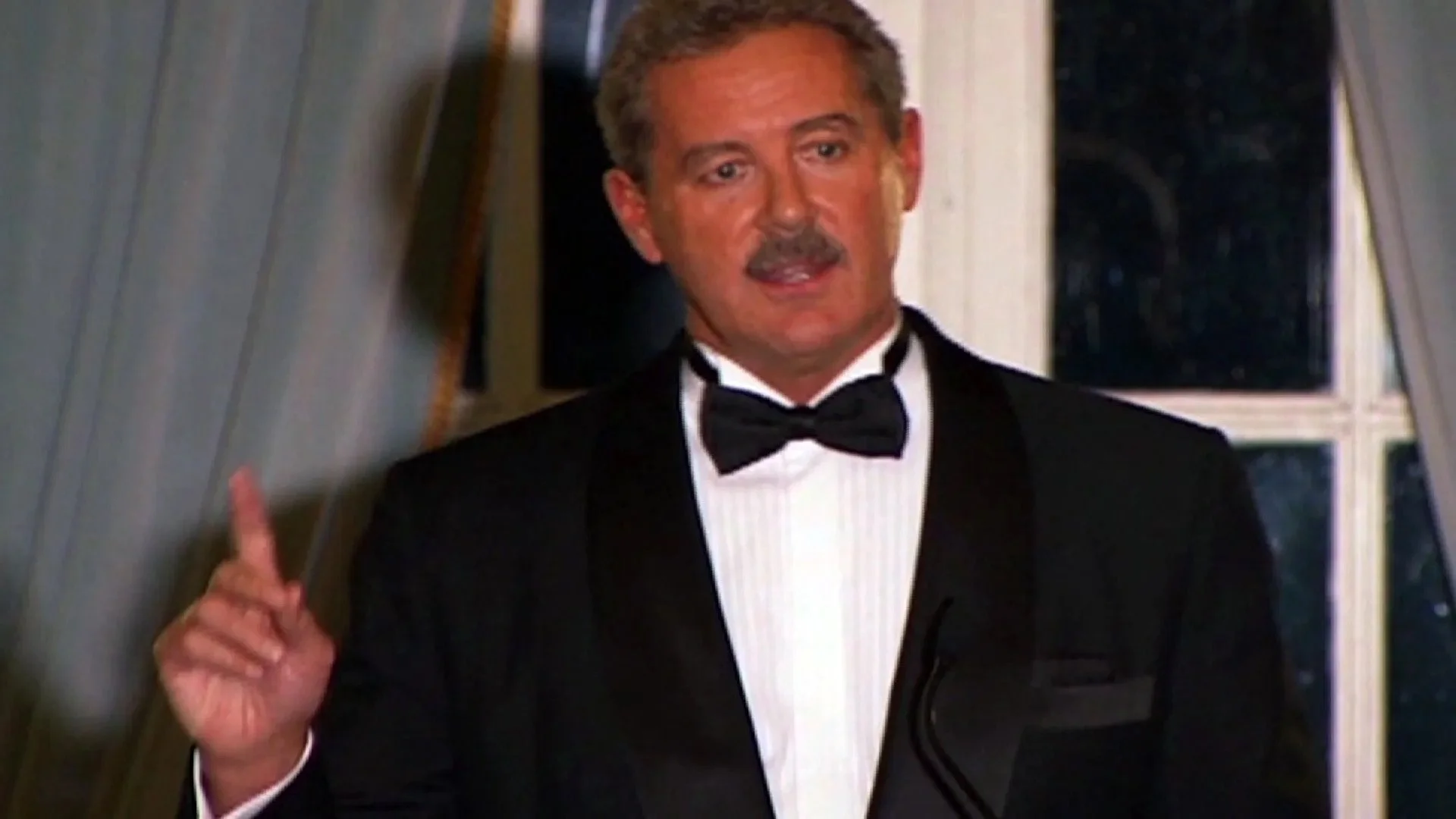

Dave Ames and the Buccament Bay Resort in SVG

Dave Ames Promoting the Buccament Bay Resort in St. Vincent and the Grenadines

David Ames is a central figure in one of the biggest Ponzi schemes to ever hit the Caribbean real estate market, specifically through his ambitious project, the Buccament Bay Resort in St. Vincent and the Grenadines (SVG). Ames sold investors on the dream of owning luxurious villas and properties within a world-class resort through his company, Harlequin Property. The sales pitch was compelling: invest in a slice of paradise and enjoy high returns on your investment. The promise was financial gain and the allure of a lifestyle upgrade—sun, sea, and a secure return on investment.

However, the reality behind Buccament Bay was far less glamorous. Ames had constructed a classic Ponzi scheme, using the funds from new investors to pay returns to earlier ones, thereby maintaining the illusion of a successful and profitable development. The resort was mired in construction delays, and many promised amenities were never built. Despite these issues, Ames and his team continued to solicit new investments, keeping the scheme alive for as long as possible. As the flow of new money began to dry up, the scheme's fragile structure collapsed, leaving investors with nothing but broken promises and worthless contracts.

The fallout from the Buccament Bay Resort collapse was severe. Investors, many of whom had invested their life savings, were left financially devastated, and the legal battles that followed were lengthy and complex. Ames faced numerous lawsuits and was eventually declared bankrupt, which offered little consolation to those who had lost everything. The Buccament Bay scandal stands as one of the biggest Ponzi schemes in the Caribbean, serving as a potent reminder of the risks involved in real estate investments, particularly in regions where due diligence may be more challenging.

Allen Stanford and the Stanford Financial Group in Antigua

Allen Stanford - Ponzi Scheme in Antigua and Barbuda

Allen Stanford's name is synonymous with one of the largest Ponzi schemes in history, and his operations in Antigua through the Stanford Financial Group included a significant real estate component. Stanford's empire was built on the promise of high returns through investments in various sectors, including prime real estate developments in Antigua. His bank, Stanford International Bank, served as the cornerstone of his fraudulent operation, attracting investors from around the world who were lured by the bank's reputation for security and profitability. The bank's offshore status and Stanford's charm added an air of exclusivity and legitimacy, drawing in investors from all walks of life.

Stanford's real estate ventures in Antigua were marketed as premium opportunities in one of the Caribbean's most desirable locations. Investors were led to believe that their funds were being used to develop luxury properties that would generate substantial returns. However, the reality was starkly different from many of the biggest Ponzi schemes. The money was not being invested in real estate or any other ventures; instead, it was being used to pay returns to earlier investors, maintaining the facade of a thriving and profitable business. The scheme was heavily reliant on the constant influx of new money, and as long as new investors continued to pour in, the illusion of success persisted.

The collapse of the Stanford Financial Group was catastrophic, revealing a web of deceit that spanned multiple countries and billions of dollars. The impact on Antigua was profound, as the island's financial sector was deeply intertwined with Stanford's operations. When the scheme unravelled, it led to the economic ruin of countless investors and severely damaged Antigua's financial reputation on the global stage. The Stanford case serves as a sobering reminder of how even the most reputable-seeming investments can be part of the biggest Ponzi schemes in history, leaving a legacy of mistrust and financial devastation.

Andris Pukke and Sanctuary Bay in Belize

Andris Pukke - Sanctuary Bay Development Ponzi Scheme in Belize

Sanctuary Bay in Belize is another stark example of a real estate Ponzi scheme that left a trail of financial destruction. The scheme was masterminded by Andris Pukke, who presented the project as an exclusive, eco-friendly luxury community in Belize. Sanctuary Bay was marketed as a unique opportunity to invest in sustainable living, with the promise of high returns and the chance to be part of a forward-thinking development. Investors were drawn in by the project's environmental credentials and the allure of owning property in a pristine, untouched location.

However, the reality behind Sanctuary Bay was far removed from the eco-paradise that Pukke had promised. The project was, in fact, a classic Ponzi scheme, with funds from new investors being used to pay off earlier ones. The development work that was supposed to create this luxury community was either delayed or never completed, and the funds that were meant for construction were siphoned off to maintain the illusion of a profitable investment. As more investors began to demand returns, the scheme started to unravel, revealing the fraudulent nature of the project.

The collapse of Sanctuary Bay was devastating for investors, many of whom had invested not just their money but also their trust in the project's vision. The fallout included significant financial losses, legal battles, and a deep sense of betrayal among those who had been duped. Sanctuary Bay serves as a powerful reminder of the risks associated with investing in overseas real estate ventures, particularly in regions where due diligence may be more challenging. It also underscores the need for vigilance and skepticism when faced with investment opportunities that seem too good to be true, as the Caribbean has been home to some of the biggest Ponzi schemes in history.

Ying Jin and the Caribbean Galaxy in SKN

Ying Jin and Government Representatives of St. Kitts and Nevis

The Caribbean Galaxy project in St. Kitts and Nevis, led by Ying Jin, is a more recent example of real estate Ponzi schemes that have entrapped investors in the Caribbean. This scheme was particularly enticing as it combined the promise of high returns from a luxury resort development with the benefit of obtaining citizenship through the country's Citizenship by Investment (CBI) program. The dual appeal of financial returns and citizenship made this project especially attractive to investors from around the globe, who saw it as a way to secure both their financial future and their legal status in a desirable Caribbean nation.

Ying Jin's Caribbean Galaxy project was marketed as a premier development that would offer investors a stake in a lucrative real estate venture and the prestige and security of a St. Kitts and Nevis passport. However, like many of the biggest Ponzi schemes, the project was built on a foundation of deceit. Allegations of misused funds and unmet promises began to surface, revealing that the development was, in fact, a Ponzi scheme. New investments were used to pay off older investors, creating a false sense of progress and profitability. As the truth came to light, the project's collapse left many investors in financial despair, particularly those who had invested not just for monetary gain but also for the promise of citizenship.

The Caribbean Galaxy debacle is a cautionary tale for investors, particularly those drawn by the allure of dual benefits such as financial returns and citizenship. The scheme highlights the critical importance of due diligence and skepticism, even when investments are tied to seemingly reputable programs like CBI. It also underscores the need for greater regulatory oversight and transparency in the investment process, particularly in regions like the Caribbean, which have recently become hotspots for some of the biggest Ponzi schemes. For those who invested in the Caribbean Galaxy project, the dream of a luxury lifestyle in paradise quickly turned into a nightmare as the reality of the Ponzi scheme came crashing down.

The Caribbean, with its reputation as a paradise destination, has unfortunately become a prime target for Ponzi schemers looking to exploit the dreams and aspirations of investors. The region's history with Ponzi schemes, particularly in the real estate sector, is a stark reminder of the importance of vigilance, thorough research, and a healthy dose of skepticism when considering investment opportunities. The stories of Ames, Stanford, Pukke, and Jin are powerful examples of how the allure of paradise can sometimes mask the reality of one of the biggest Ponzi schemes in the making. For investors, the lesson is clear: if something seems too good to be true, it probably is, and nowhere is this more evident than in the glittering but sometimes treacherous world of Caribbean real estate.

Other Ponzi Schemes in the Caribbean

The Caribbean has not only been the stage for real estate Ponzi schemes but has also witnessed a variety of financial frauds that have rocked the region. While real estate schemes often capture the headlines due to their high-profile nature, other Ponzi schemes across different sectors have also left deep scars on investors and the financial integrity of Caribbean nations. These schemes, although varied in their execution, share a common thread of deceit and exploitation, often leading to catastrophic consequences for those involved. Here, I dive into some of the other biggest Ponzi schemes that have struck the Caribbean, shedding light on their operations and their impact.

Sam Bankman-Fried and FTX in The Bahamas

Sam Bankman-Fried - Founder of the CFTX

One of the most high-profile financial collapses in recent memory is that of Sam Bankman-Fried's FTX, a cryptocurrency exchange based in The Bahamas. FTX quickly rose to prominence, becoming one of the largest cryptocurrency exchanges in the world and promising substantial returns to its investors. However, beneath the surface, the company operated in a manner that bore striking similarities to a classic Ponzi scheme. The returns to earlier investors were financed not through legitimate business operations but by new investors' capital. This created a house of cards that eventually came crashing down when the truth was revealed.

Although not a real estate Ponzi scheme, the magnitude of FTX's collapse had a ripple effect that was felt across the financial world. The downfall of FTX mirrors the destructive power of the biggest Ponzi schemes, where the promise of extraordinary returns blinds investors to the underlying risks. The case of FTX underscores the critical need for investor vigilance, particularly in emerging and volatile sectors like cryptocurrencies. The lessons from FTX are clear: regardless of the investment type, the potential for fraud is always present, and due diligence is essential to protecting one's assets.

David A. Smith and Olint Corp in Jamaica

David A. Smith - Forex Scam Based in Jamaica

David A. Smith, another notorious figure in the world of financial fraud, orchestrated one of the largest Ponzi schemes in the Caribbean through his operation, Olint Corp. Based in Jamaica, Olint Corp promised investors high returns from foreign exchange (forex) trading. Smith's scheme captivated a broad base of investors from Jamaica and beyond, many enticed by the sophisticated image and the allure of significant financial gains. However, as with all Ponzi schemes, the returns promised by Olint Corp were unsustainable, and the operation eventually collapsed under its weight.

Smith's scheme ran into the hundreds of millions, making it one of the biggest Ponzi schemes in the Caribbean. The fallout from the collapse of Olint Corp was devastating, leaving countless investors with significant financial losses and a deep mistrust of investment opportunities. The case of David A. Smith and Olint Corp is a stark reminder of the dangers of investing in high-risk ventures that promise extraordinary returns with little to no transparency. It also highlights the importance of understanding the underlying mechanics of any investment, particularly those that involve complex financial instruments like forex trading.

William Wise and Millenium Bank in the West Indies

William Wise - Founder of Millenium Bank in the Caribbean

William Wise's Millenium Bank is another classic example of a Ponzi scheme that operated out of the Caribbean, specifically the West Indies. Millenium Bank presented itself as a legitimate banking institution, offering high-yield returns on Certificates of Deposit (CDs). The scheme was particularly insidious because it masqueraded as a reputable financial institution, complete with all the trappings of legitimacy. Investors were drawn in by the promise of safe, high-return investments, a prospect that seemed particularly appealing during times of economic uncertainty.

However, Millenium Bank was nothing more than a front for one of the biggest Ponzi schemes in the region. Wise used the funds from new investors to pay returns to earlier investors, maintaining the illusion of a successful operation. The scheme eventually unravelled, leaving investors with worthless certificates and significant financial losses. The Millenium Bank case is a powerful reminder of the lengths to which fraudsters will go to lend their schemes an air of credibility. It underscores the importance of thorough due diligence when entrusting one's finances to any institution, no matter how reputable it may seem on the surface.

Accelerated Capital Firm Inc. in Guyana

In Guyana, Accelerated Capital Firm Inc. became synonymous with financial fraud after it was revealed to be a Ponzi scheme that promised investors unusually high returns on their investments. The firm operated under the guise of a legitimate investment company, attracting a wide range of investors with the promise of quick and substantial profits. Like many other biggest Ponzi schemes, it relied on the continuous influx of new investors to pay returns to earlier ones, creating a cycle that was ultimately unsustainable.

The collapse of Accelerated Capital Firm Inc. highlighted the dangers of unchecked investment offers that promise exorbitant returns without precise, sustainable revenue mechanisms. The fallout from the scheme was significant, with many investors losing their savings and facing financial ruin. The case serves as a critical lesson in the importance of regulatory oversight and the need for investors to be wary of offers that seem too good to be true. In the investment world, skepticism and due diligence are essential tools for protecting oneself from the devastating impacts of Ponzi schemes.

While unique in their specifics, each of these cases underlines the persistent risk of Ponzi schemes in the Caribbean and globally. The allure of quick, high returns often blinds investors to the realities of these fraudulent schemes. Whether it's through real estate Ponzi schemes or other financial frauds, the lesson remains clear: investor diligence, skepticism of over-promising offers, and a solid understanding of where and how your money is being invested are paramount to avoiding the devastating impacts of these schemes. The Caribbean's recent history, including some of the biggest Ponzi schemes , is a stark reminder of the need for vigilance in all investment endeavors.

The Aftermath of Ponzi Schemes

Failed Development from Ponzi Scheme in the Caribbean

In this section, I'll delve into the repercussions of Ponzi schemes, focusing not just on the immediate impact on victims and investors, but also the legal consequences faced by those orchestrating these frauds. Moreover, I'll touch on the need for enhanced certifications for real estate agents, a measure that could serve as a preventive tool against real estate Ponzi schemes.

Impact on Victims and Investors

The fallout from Ponzi schemes, particularly those masquerading as lucrative real estate investments, goes far beyond financial losses. Victims often experience profound psychological and emotional distress, finding themselves mired in debt, with their life savings wiped out. Take the cases mentioned earlier, like David Ames' Buccament Bay Resort; investors were lured by the promise of paradise, only to have their hopes dashed. In the aftermath, many find it challenging to trust any investment opportunity, developing an aversion to financial markets that can hinder their future financial decisions.

The societal impact is equally devastating. Besides individual financial ruin, Ponzi schemes can erode public confidence in investment markets. This skepticism can lead to decreased investment in legitimate ventures, stifling economic growth and innovation. For communities, especially those in developing regions like the Caribbean, the damage to investor confidence can deter much-needed foreign investment, slowing local economic development and prosperity.

Legal Repercussions for Perpetrators

The legal consequences for those behind Ponzi schemes are severe, intended not just to punish but also to deter others from committing similar frauds. For example, perpetrators like David Ames face lengthy prison sentences, hefty fines, and the seizure of assets. These legal actions serve as a crucial reminder of the risks involved in engaging in fraudulent activities.

However, prosecuting Ponzi schemes, especially those with international ties like many of the largest Ponzi schemes, presents complex legal challenges. It requires collaboration across jurisdictions and a deep understanding of different legal systems. This complexity often prolongs the legal process, delaying justice for the victims.

Certifications for Real Estate Agents

To combat real estate Ponzi schemes effectively, I advocate for more stringent certifications for real estate agents. These certifications should encompass thorough training on ethical standards, an in-depth understanding of how Ponzi schemes operate, and the ability to recognize the warning signs of fraudulent investments.

By enhancing the certification process for real estate agents, the industry can take a proactive stance in safeguarding investors. Certified agents can serve as the first line of defense, equipped to spot and report potential Ponzi schemes before they ensnare unsuspecting victims. While not a panacea, this measure, combined with increased public awareness and rigorous enforcement of existing laws, can significantly mitigate the risk posed by these fraudulent schemes.

The aftermath of Ponzi schemes underscores the need for vigilance, stringent legal repercussions for perpetrators, and preventive measures like enhanced certifications for real estate professionals. These steps are crucial for restoring and maintaining investor confidence, particularly in markets vulnerable to such scams.

Preventing Ponzi Schemes

How to Avoid Ponzi Schemes in the Caribbean

In my experience researching the most notorious financial frauds, including the largest Ponzi schemes ever uncovered, I've identified crucial steps to prevent them. This preventive strategy is especially relevant given the prior discussions on real estate Ponzi schemes and the likes of David Ames. My insights draw on these examples to offer a comprehensive approach to safeguard against these devastating schemes.

Educate Investors

First and foremost, educating investors is paramount. I cannot stress enough the importance of understanding the basic principles of investments, including the risks associated with high-return promises. Ponzi schemes, such as those orchestrated by Ames, prey on the uninformed. Vigilance starts with knowledge.

Due Diligence

Practicing due diligence before investing is another essential measure. This involves researching the investment firm, checking the credentials of its agents, and understanding where the money goes. My review of various cases reveals that due diligence could have uncovered inconsistencies or falsehoods in the schemes' operations.

Regulatory Oversight

Strengthening regulatory oversight is critical. Agencies must be proactive and relentless in their investigations, as the SEC's failure to act on early warnings in the Madoff case illustrates. Enhanced monitoring and the swift action against suspicious activities can deter Ponzi schemes.

Transparency

Demanding transparency from investment firms is key. Investors should have full access to the firm's financial statements and operations. In the context of real estate ponzi schemes, this means knowing exactly how properties are managed, who owns them, and how returns are generated.

Collaboration

Finally, fostering collaboration between investors, regulators, and industry professionals can create a hostile environment for Ponzi schemes. Sharing information and raising the alarm on questionable practices can prevent potential schemes from taking root.

By implementing these strategies, I believe we can significantly mitigate the risk of falling prey to a Ponzi scheme. It requires a collective effort from all parties involved in the investment landscape to protect against these fraudulent activities.

Investor Education and Qualification

Investing in today's dynamic market requires more than a keen interest; it demands rigorous education and a clear understanding of what qualifies as a legitimate investment opportunity versus a potential fraud. My focus in this section shifts toward emphasizing the crucial role of investor education and proper qualification methods, especially in the context of real estate investment and avoiding Ponzi schemes.

Regulatory Measures and Legal Protections

Navigating the investment landscape can be daunting, particularly with the specter of Ponzi schemes lurking in the shadows. However, regulatory bodies and legal frameworks serve as the first line of defense against these fraudulent schemes. In my experience, staying informed about regulatory measures is paramount. These measures, including oversight by the Securities and Exchange Commission (SEC) and adherence to the Dodd-Frank Wall Street Reform and Consumer Protection Act in the United States, provide a framework for monitoring investment activities and ensuring compliance with the law.

Legal protections further fortify investors' safety nets. For instance, laws requiring detailed disclosures about investment products and their associated risks help investors make informed decisions. Additionally, legal recourse is available for victims of Ponzi schemes—something that every investor should be aware of. Understanding these protections empowers investors to not only recognize red flags but also take action if they suspect fraudulent activities.

Certifications for Real Estate Agents

The realm of real estate investments is not immune to the dangers of Ponzi schemes. Instances involving figures like David Ames and his Buccament Bay Resort project highlight the necessity of due diligence in real estate transactions. One effective preventive measure I advocate for is the introduction and enforcement of rigorous certifications for real estate agents.

Such certifications should encompass a comprehensive understanding of financial regulations, ethical investment practices, and the ability to discern and disclose potential risks associated with property investments. By ensuring that real estate agents are well-educated and certified, aspiring investors can rely on expert guidance, significantly reducing the risk of falling prey to Ponzi schemes disguised as lucrative real estate opportunities.

Investor education and the qualification of real estate professionals stand as critical pillars in building a secure investment environment. By focusing on these areas, we fortify the investment community's resilience against the allure of seemingly high-return, yet fraudulent schemes. As investors become more knowledgeable and demand higher standards of professionalism from advisors, the fertile ground on which Ponzi schemes thrive becomes decidedly less hospitable.

Conclusion

Bernie Madoff - The Biggest Ponzi Scheme in the World

In my exploration of some of the largest Ponzi schemes, I've researched notorious cases that have left indelible marks on the financial industry. Two such schemes, orchestrated by Tom Petters and Michael DaCorta, highlight the depths of deceit involved in these fraudulent activities. Petters' nearly $4 billion fraud and DaCorta's $80 million foreign-exchange trading scheme exemplify the significant impact these scams have on investors and the economy.

The real estate sector, particularly, has witnessed its share of Ponzi schemes. Figures like David Ames, through developments like the Buccament Bay Resort, have shown how the allure of luxurious investments can mask underlying fraud. This underscores the critical need for investor education and due diligence in real estate investments to identify red flags early.

The aftermath of Ponzi schemes—ranging from devastating financial losses for investors to stringent legal repercussions for the perpetrators—stresses the importance of preventive measures. Regulatory oversight, transparency in operations, and collaboration among stakeholders are essential to fend off such schemes. Educating investors about the hallmarks of Ponzi schemes, alongside enhancing legal and regulatory frameworks, can significantly mitigate the risks associated with these fraudulent activities.

As I've highlighted in my article, the collective implementation of these strategies is crucial in creating a secure investment environment. Through informed decision-making and vigilance, investors can protect themselves against falling prey to Ponzi schemes. Advocating for transparency and supporting regulations that hold fraudsters accountable are steps in the right direction toward safeguarding the financial landscape from such scams.

Frequently Asked Questions

What are the most notorious Ponzi schemes in Caribbean history?

The Caribbean has been the backdrop for several notorious Ponzi schemes, particularly in the real estate sector. Among the most infamous are David Ames' Buccament Bay Resort in St. Vincent and the Grenadines, Allen Stanford's Stanford Financial Group in Antigua, and Andris Pukke's Sanctuary Bay in Belize. Each of these schemes lured investors with promises of high returns and luxury living, only to collapse and leave financial devastation in their wake.

Why did Ponzi schemes seem to flourish in the Caribbean?

The Caribbean’s allure as a paradise destination, combined with its complex financial landscape and often lenient regulatory environments, makes it an attractive target for Ponzi schemers. The promise of owning luxury property in a tropical paradise or obtaining citizenship through investment programs like those in St. Kitts and Nevis adds to the appeal, drawing in investors who might overlook the risks.

How can investors protect themselves from Ponzi schemes?

Investors can protect themselves by conducting thorough due diligence before committing to any investment. This includes researching the credibility of the investment firm, understanding the specific market conditions, and being wary of offers that promise guaranteed high returns with little to no risk. It’s also crucial to verify that the investment is properly regulated by local authorities and to seek independent advice when necessary.

Are Citizenship by Investment (CBI) programs in the Caribbean linked to Ponzi schemes?

While Citizenship by Investment (CBI) programs themselves are legitimate and regulated, they have occasionally been linked to fraudulent real estate projects that turned out to be Ponzi schemes. For example, Ying Jin's Caribbean Galaxy project in St. Kitts and Nevis offered investors both citizenship and financial returns, but ultimately collapsed as a Ponzi scheme. Investors should be cautious and thoroughly vet any real estate development associated with CBI programs.

How do Ponzi schemes in the Caribbean typically operate?

Ponzi schemes in the Caribbean often operate by promising high returns on investments in real estate, luxury developments, or other ventures that seem legitimate on the surface. The schemers use funds from new investors to pay returns to earlier investors, creating a false appearance of profitability. These schemes rely on the continuous influx of new money to stay afloat, and they collapse when new investments dry up or when too many investors demand their returns.

Have any Caribbean Ponzi scheme perpetrators faced significant legal consequences?

Yes, several perpetrators of Ponzi schemes in the Caribbean have faced significant legal consequences. For instance, Allen Stanford was convicted and sentenced to 110 years in prison for his role in the Stanford Financial Group Ponzi scheme. Similarly, David Ames faced legal action and was declared bankrupt following the collapse of the Buccament Bay Resort scheme. However, the legal process can be lengthy and complex, especially when dealing with cross-border fraud.

What role does offshore banking play in Caribbean Ponzi schemes?

Offshore banks in the Caribbean have sometimes played a central role in Ponzi schemes, offering a veneer of legitimacy and security to attract investors. These banks may operate with less stringent regulations than onshore institutions, making it easier for schemers to manipulate funds and avoid detection. In cases like Allen Stanford’s Stanford International Bank in Antigua, the offshore banking system was instrumental in maintaining the illusion of a successful investment operation.

How can real estate agents and industry professionals help prevent Ponzi schemes in the Caribbean?

Real estate professionals can help prevent Ponzi schemes by adhering to strict ethical standards, conducting thorough due diligence on developments they promote, and educating potential investors about the risks. By ensuring transparency in real estate transactions and verifying the legitimacy of investment opportunities, real estate agents can serve as a crucial line of defence against fraudulent schemes. Additionally, advocating for more stringent certifications and regulatory oversight in the industry can help mitigate the risk of such schemes.

Bio

Dan Merriam

Caribbean Real Estate Investor

Advisor @ Sotheby’s International Realty

Partner @ InvestCARICOM

Helping high-net-worth investors and global families buy and sell Caribbean real estate, navigate citizenship by investment, and implement cross-border strategies for residency, tax optimization, and long-term wealth protection.

Schedule a personalized 1-on-1 consultation with Dan Merriam to gain trusted guidance on Caribbean real estate, offshore structuring, and avoiding the pitfalls of risky investment schemes. With a background in both real estate and entrepreneurship, Dan brings a critical lens to investment opportunities—helping clients evaluate risk, spot red flags, and protect their assets. As a representative of Sotheby’s International Realty and partner at InvestCARICOM, he offers expert insight into the region’s opportunities while helping clients avoid its financial traps.

Writer in Tax Reduction, International Tax Planning, Citizenship by Investment, Caribbean, Second Residence, Real Estate Investing, Ponzi Schemes in the Caribbean, FTX Exchange, Sam Bankman-Fried, Failed Real Estate Developments, Asset Management, Lifestyle Planning, Company Formation, Offshore Banking, Asset Protection, Technology, Entrepreneurship

This article is for informational purposes only; it should not be considered financial, tax planning or legal advice. Consult a financial or investment professional before making any major financial decisions.